What is the UTXO model?

The UTXO model is a legacy technology created for managing account balance state and transactions. How does it stack up against the latest solutions?

Written by Kacper Tomasiak

Mar 6, 2025

Sending and receiving crypto sounds easy, but do you know how it actually works? Different blockchains use varying approaches to manage your funds, and the UTXO model is one of these.

While Bitcoin and Litecoin utilize UTXOs, Ethereum and Solana use account-based models. One can argue that the former is better than the latter or the other way around, but the truth is that either has their ups and downs. So, what’s the deal?

Understanding the UTXO model

The Unspent Transaction Output model, or UTXO in short, is a way to track transactions on a blockchain. Unlike traditional banking, each transaction represents amounts of unspent cryptocurrency like change when paying with cash.

How transactions work in UTXO

Each UTXO transaction consists of a few components—inputs, outputs, and transaction fees.

UTXO example

Let’s say Josh has 1 BTC in his wallet and wants to send Alice 0.25 BTC. The transaction would look like this: a UTXO of 1 BTC, a UTXO of 0.25 BTC sent to Alice, and a change of approximately 0.75 BTC minus fees that go to miners. In conclusion, from just 1 UTXO, two new UTXOs are created.

Cash transactions analogy

The UTXO model wasn’t created out of thin air; it is the result of real-life observations and works just like cash transactions.

Think about paying for a $5 coffee with a $20 bill (UTXO input). You are then given $15 in change (new UTXO output). The $5 is spent and belongs to the cafe (another new UTXO output).

You can’t divide a bill without getting change; therefore, new UTXOs are being created in every transaction.

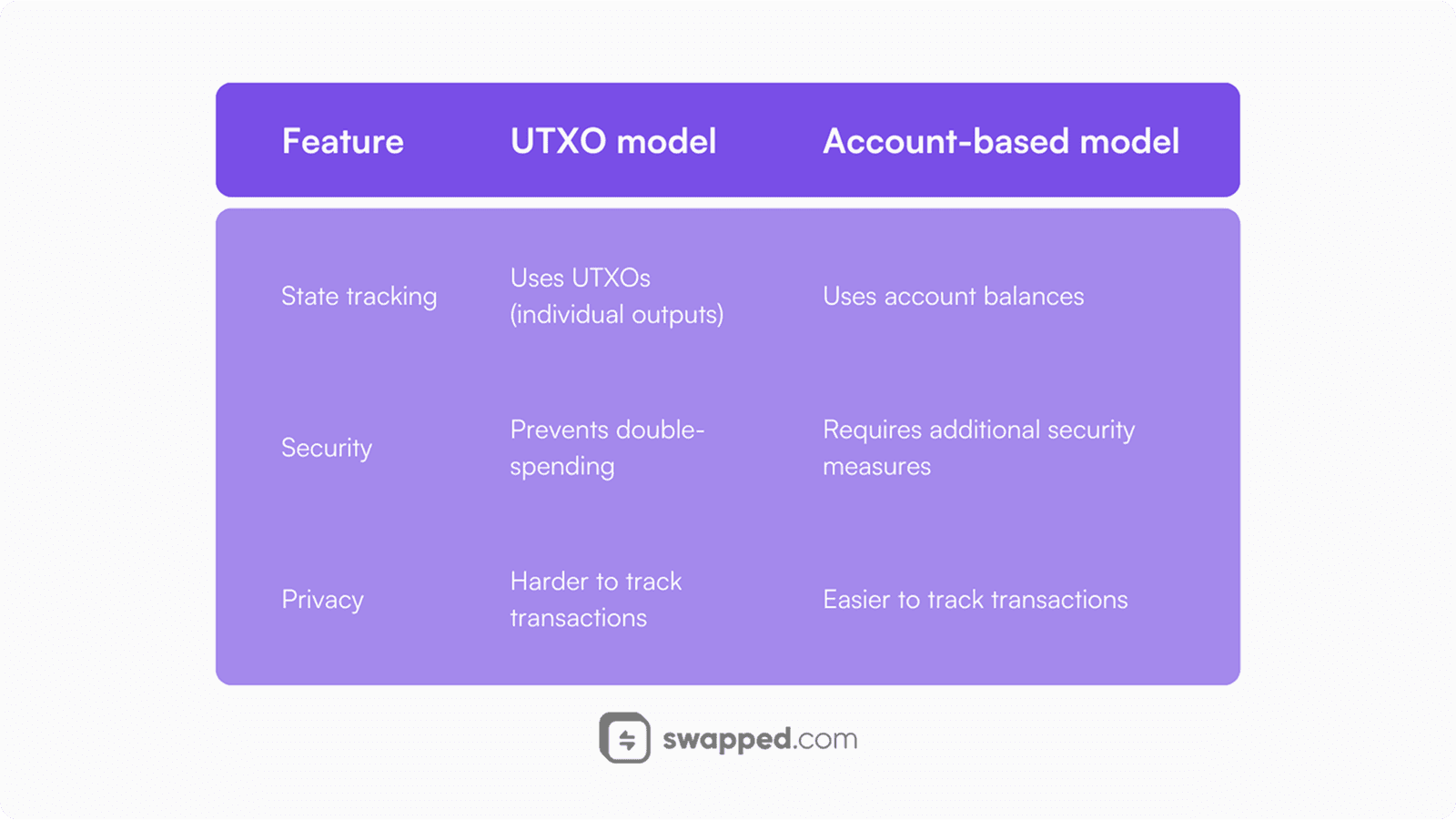

UTXO model vs account-based model

Both the UTXO and the account-based models have their own fair share of upsides and drawbacks—let’s explore.

The UTXO model and the account-based model are two distinct approaches to managing funds and transactions on a blockchain network.

Benefits of UTXO and account-based models

The UTXO model is excellent for security as it prevents a rather significant issue of double-spending. Also, each time you make a transaction, new UTXOs are created, making it a lot harder to track the coins.

The account-based model makes tracing balances a breeze and supports full-fledged smart contracts.

Challenges of UTXO and account-based models

It’s a well-known fact that Bitcoin, a UTXO-based blockchain, struggles in terms of smart contract capabilities and scalability. Although progress has been made with the Taproot upgrade and Ordinals, Bitcoin will never get anywhere near Ethereum or Solana, because since inception it wasn’t meant to be a decentralized computer.

When it comes to double spending, account-based blockchains need additional security measures like ensuring the balance is synchronized to prevent this type of fraudulent behavior.

Summary

Ultimately, it all comes down to what a crypto was made for. If speed and smart contracts are a top priority, then the account-based model is the best pick. Yet if security and a degree of anonymity are higher on the list, the UTXO model as a choice is a no brainer.

Why does Bitcoin use the UTXO model?

With so many downsides, one may ask why Bitcoin still runs on the UTXO model—a perfectly valid question.

Security

Satoshi envisioned Bitcoin to be decentralized money, and at the time of development, UTXOs seemed to be the best solution to double-spending. UTXOs are made immutable—once spent, they can’t be used again. Therefore, manipulating balances is hardly possible to pull off.

Scalability

Because UTXOs are independent, multiple transactions can happen and be validated in parallel. This makes it much more efficient than where a transaction must update a shared global state. Still, Bitcoin is considered slow due to smaller block sizes and block times of around 10 minutes. This sacrifice was made for the greater good—decentralization.

Privacy

Since users spend UTXOs and do not update the balance of a single address, it makes linking transactions to a single entity way harder. Also, before receiving a deposit to your account, UTXO-based blockchains can regenerate addresses for each transaction.

Why Ethereum doesn't use UTXO

With conquering the global internet and establishing Web 3.0 in mind, why did Ethereum, or its founders to be precise, choose an imperfect and flawed account model?

Ease

Despite the need for many more security measures, the account-based model is simple and predictable. The one task it has is to update the shared global state of account balance when coins are sent or received. Ethereum, being the complex blockchain it is, needs to make sure the basics stay as simple as they can get.

Efficient interactions

Ethereum was made to be a global decentralized computer, a foundation for the new internet—that is a fact. In order to handle the interactions with sometimes complex smart contracts, the approach had to be suitable, and UTXOs clearly aren’t.

Faster validation

What’s not to understand? Checking if a transaction is valid, especially the more complex it gets, is much easier on blockchains like Ethereum than it would be on Bitcoin.

What is crypto dust?

Exploring the fascinating world of crypto, you must have stumbled upon crypto dust. Dust in crypto is what small balances are called, whether it's tokens or network-native coins you use to pay for fees.

Dust in UTXOs

Over time, a frequently used wallet may accumulate many small UTXOs, and moving those coins can actually cost more than the value of the assets themselves.

Dust solutions

To sort out your issue, you have to first be able to define it. To group multiple small UTXOs, you can use dust consolidation features that some wallets support. Are you trying to get rid of spam tokens and NFTs? Use the burn feature in your wallet to do so. Additionally, if you happen to have small bits of different cryptos on a centralized exchange, you can just convert these tiny balances into the official exchange token in most cases.

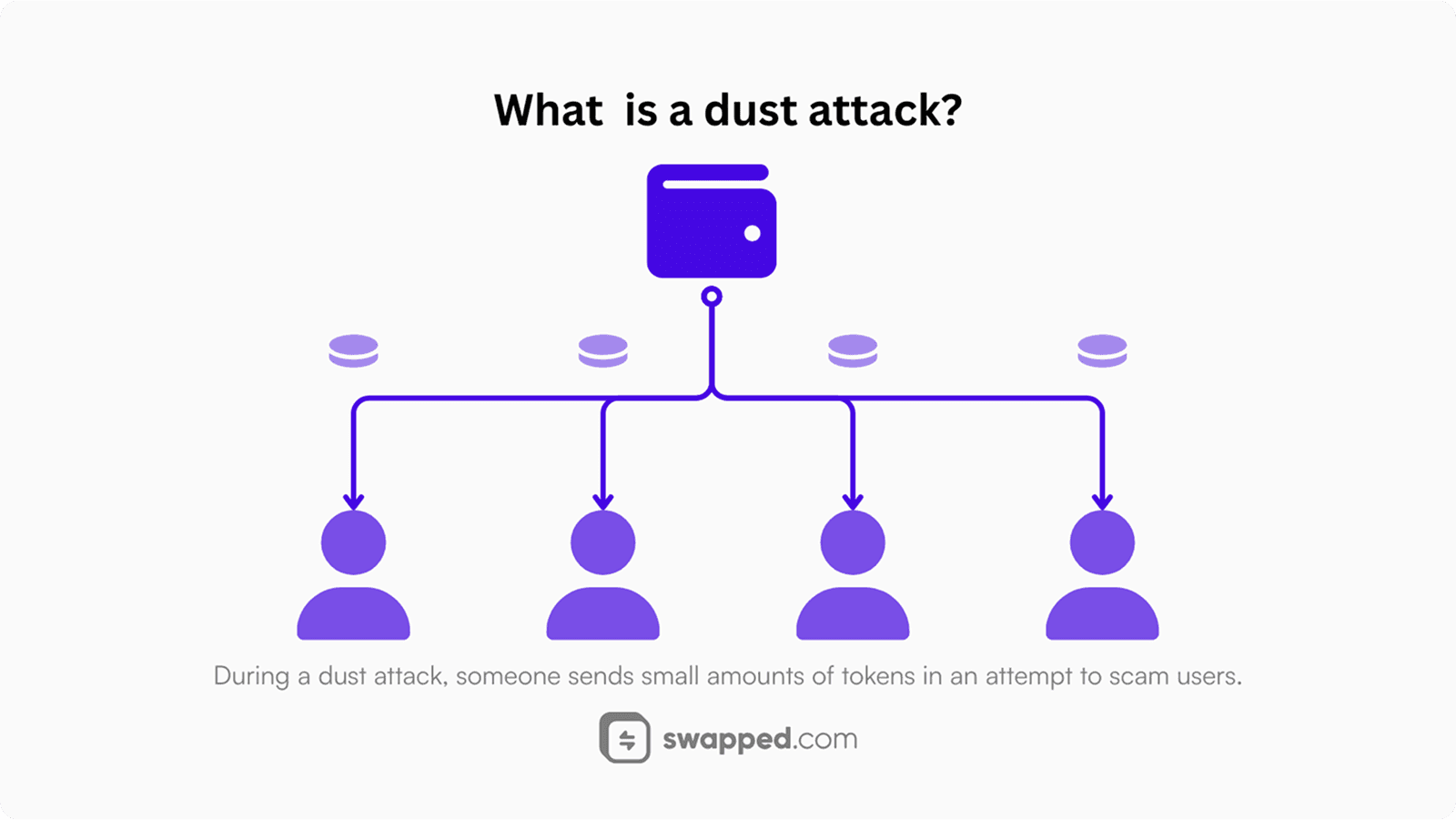

Dust attacks

A dust attack is when a wallet or a group of wallets sends out small amounts of tokens. The idea? To get the target victim to interact with the token or a website and drain their funds. As unrealistic as it may sound, fortunes were lost because of the lack of attention to details or just pure greed.

A dust attack is an illicit activity that aims to extract money from the target.

Why UTXO still matters

The technology behind UTXOs is definitely classified as one of the older ones but is still being reinvented with new, sometimes surprising, use cases.

Who knows? Perhaps, in the future, UTXO-based blockchains like Cardano will have the potential to even rival the latest generation of blockchain networks in terms of smart contracts and other soon-to-be-revealed features.

Resources

If you're interested in diving deeper and expanding your knowledge of the UTXO model, here are some suggestions: