What is Bitcoin (BTC)?

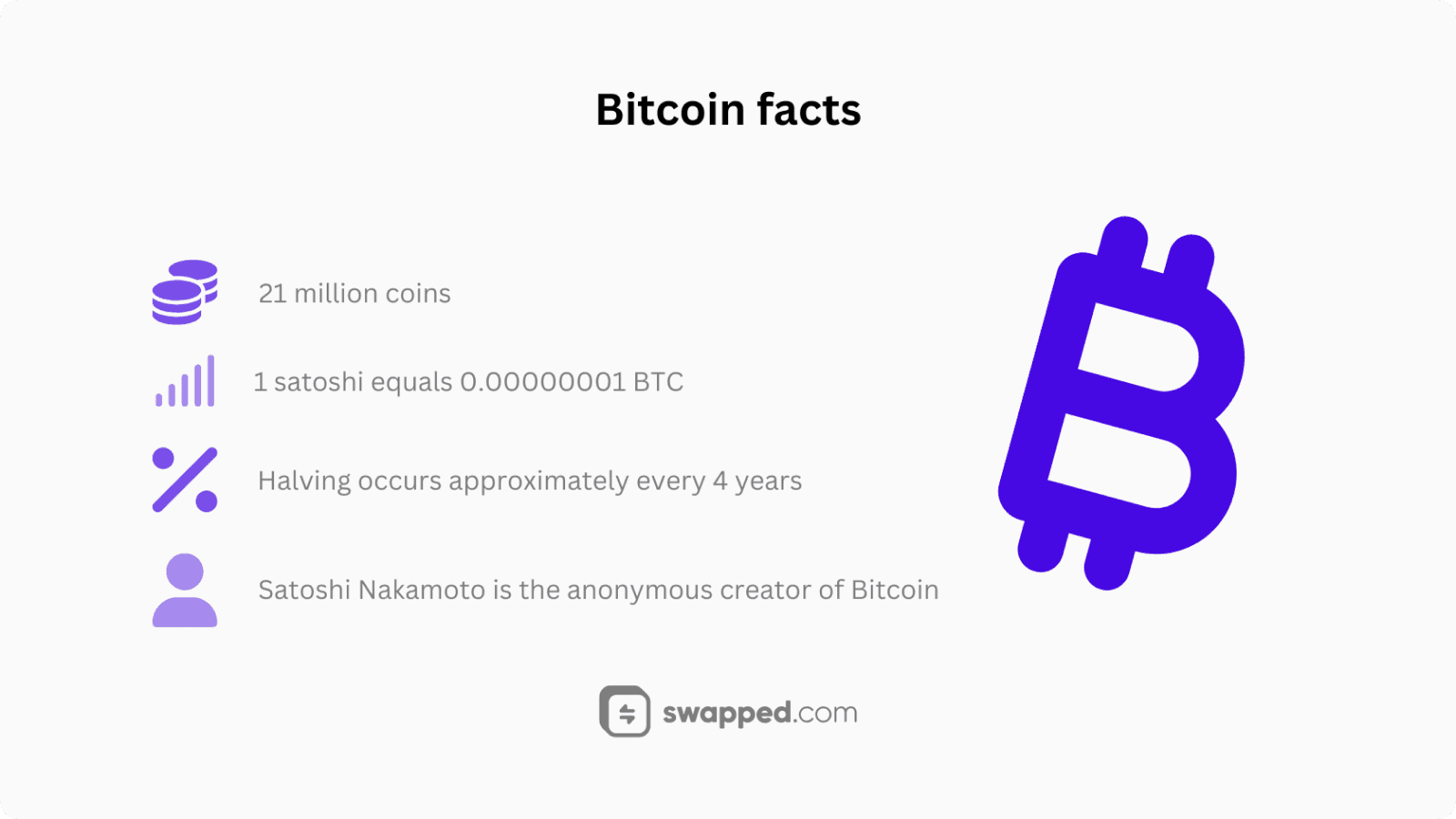

Bitcoin (BTC) is the first decentralized digital currency, enabling peer-to-peer transactions without banks. Launched in 2009, it relies on blockchain technology for transparency and security, with a limited supply of 21 million coins.

Written by Kacper Tomasiak

Nov 3, 2024

Remember the first time someone explained the Internet to you? It probably sounded confusing, maybe even unnecessary. "Why would I need to send messages through a computer when I can just call someone?" Fast forward to today, and we can't imagine life without it. Right now, we're living through a similar moment with Bitcoin (BTC)—a new kind of money that's reshaping how we think about value, ownership, and financial freedom.

Bitcoin might sound complicated at first, but stick with us. By the end of this guide, you'll understand what Bitcoin is, how it works, and why millions of people around the world believe it's the future of money. No jargon, no confusing tech-speak—just clear, honest answers to the questions you're probably already asking.

Where did Bitcoin come from?

The story of Bitcoin starts in 2008, right in the middle of a massive financial crisis. Banks were failing, people were losing their savings, and trust in the traditional financial system was crumbling. In the midst of this chaos, someone (or maybe a group of people) using the name Satoshi Nakamoto published a document online called "Bitcoin: A Peer-to-Peer Electronic Cash System."

This wasn't just a technical paper. It was a vision for a completely different kind of money—one that didn't need banks, governments, or any middleman at all. Instead of trusting institutions, people would trust math and technology. On January 3, 2009, Satoshi mined the first Bitcoin block, known as the Genesis Block, and embedded a message in it: a newspaper headline about banks being bailed out with taxpayer money. The message was clear: Bitcoin was created as an alternative to a broken system.

The mystery behind the creator

Here's where it gets interesting. Nobody knows who Satoshi Nakamoto really is. Despite countless investigations, documentaries, and theories, Satoshi's identity remains one of the biggest mysteries in modern technology. In 2010, Satoshi simply disappeared, leaving the project in the hands of a growing community of developers and enthusiasts.

Satoshi is believed to own around one million Bitcoins, which would be worth billions of dollars today. Yet those coins have never been moved. This quiet disappearance adds a layer of intrigue to Bitcoin's story and reinforces one of its core principles: Bitcoin doesn't belong to any one person or organization. It belongs to everyone who uses it.

An abstract visualization of Bitcoin creator Satoshi Nakamoto whose identity remains a mystery.

What exactly is Bitcoin?

At its simplest, Bitcoin is digital money. It exists entirely online, with no physical coins or bills. You can't hold it in your hand, but you can own it, send it, and receive it just like regular money—except it works completely differently under the hood.

Unlike dollars, euros, or any other government-issued currency, Bitcoin isn't controlled by a central authority. There's no Federal Reserve, no central bank, and no government deciding how much Bitcoin exists or who can use it. Instead, Bitcoin runs on a network of computers around the world, all working together to maintain and secure the system. This is what we mean when we say Bitcoin is decentralized.

The Bitcoin blockchain

Bitcoin's secret sauce is something called blockchain technology. Think of it as a giant, public notebook that records every Bitcoin transaction ever made. This notebook isn't stored in one place—it's copied and updated across thousands of computers simultaneously, making it nearly impossible to hack or manipulate.

Every time someone sends Bitcoin, that transaction gets added to the blockchain. Once it's there, it's permanent. You can't erase it, change it, or fake it. This transparency and permanence are what make Bitcoin trustworthy, even without a bank verifying everything.

How does Bitcoin actually work?

Let's walk through how Bitcoin works in practice, step by step.

Getting your Bitcoin wallet

To use Bitcoin, you need a wallet. Don't worry—it's not a physical thing you carry around. A Bitcoin wallet is a digital tool, usually an app on your phone or computer, that lets you store, send, and receive Bitcoin.

Your wallet generates a unique address—kind of like an email address—that you share with people who want to send you Bitcoin. You also get a private key, which is like a password that proves you own the Bitcoin in your wallet. Lose your private key, and you lose access to your Bitcoin forever. That's why keeping it safe is crucial.

Sending Bitcoin to someone else

Let's say you want to send Bitcoin to a friend. You open your wallet, enter their Bitcoin address, type in the amount you want to send, and hit send. Your transaction gets broadcast to the Bitcoin network, where it waits to be verified.

This is where things get interesting. Your transaction doesn't just get approved instantly by a bank. Instead, it enters a pool of pending transactions waiting to be confirmed by miners.

The miners who keep Bitcoin running

Bitcoin miners are like the unsung heroes of the network. They use powerful computers to solve complex math puzzles, and the first miner to solve the puzzle gets to add a batch of transactions (called a block) to the blockchain. As a reward, they receive newly created Bitcoin—this is how new Bitcoins enter circulation.

Mining requires a lot of computing power and electricity, but it's also what keeps Bitcoin secure. The more miners there are, the harder it becomes for anyone to cheat the system.

It’s critical to understand the basic concepts of Bitcoin before moving on to more complex topics.

Why does Bitcoin have value?

This is one of the most common questions beginners ask. After all, Bitcoin is just code, right? So why is it worth anything?

Scarcity makes it valuable

Bitcoin's supply is capped at 21 million coins. That's it. No more will ever be created. This built-in scarcity is similar to gold—there's only so much of it, which makes it valuable. As demand for Bitcoin grows and the supply stays fixed, its value tends to increase over time.

No single point of failure

Because Bitcoin is decentralized, no government or company can shut it down, freeze your account, or print more of it to cause inflation. This makes it especially appealing in countries where banks are unstable or governments restrict financial freedom. Bitcoin gives people control over their own money.

Growing real-world use

Bitcoin isn't just a speculative investment anymore. Businesses around the world accept Bitcoin as payment. El Salvador even made it legal tender alongside the US dollar. Payment apps, online retailers, and even some brick-and-mortar stores now support Bitcoin transactions. The more places you can use Bitcoin, the more valuable it becomes as a currency.

Common risks you should know about

Bitcoin is exciting, but it's important to understand the risks before diving in.

Price swings can be wild

Bitcoin's price is notoriously volatile. It can go up or down by thousands of dollars in a single day. This volatility makes Bitcoin risky for short-term trading, but many people see it as a long-term store of value, similar to digital gold.

Regulations are still evolving

Governments around the world are still figuring out how to regulate Bitcoin. Some embrace it, others restrict it, and a few have banned it outright. Regulatory changes can impact Bitcoin's price and how easily you can buy or use it, so it's worth keeping an eye on the news.

Scams and security threats

The crypto world attracts scammers. Fake websites, phishing emails, and fraudulent investment schemes are common. Always use trusted platforms and wallets. Never share your private key with anyone, and be skeptical of offers that sound too good to be true.

How to buy and store BTC?

To buy Bitcoin, you’ll need a platform that lets you buy cryptocurrencies. For instance, you can use a crypto on-ramp like Swapped.com, which supports several payment methods such as Apple Pay, Google Pay, credit cards, PayPal or bank transfer. Just choose the amount, the payment method, and your BTC will be delivered in minutes.

As for storing BTC, it’s best to set up a digital wallet. You can either download an app or purchase a physical divide known as a hardware wallet. Hardware wallets such as a Ledger or a Trezor add an extra layer of security by keeping your coins offline.

Bitcoin initiated the financial revolution that transformed the way we perceive money.

What makes Bitcoin different from traditional money?

Bitcoin challenges everything we've been taught about money. Traditional currencies are issued and controlled by governments. They can print more money whenever they want, which can lead to inflation and devaluation. Bitcoin, on the other hand, is limited, transparent, and operates independently of any central authority.

With Bitcoin, you don't need to trust a bank to hold your money or process your payments. You don't need permission to send money across borders. And you don't need to worry about a government freezing your account. Bitcoin gives you financial sovereignty—the power to control your own wealth.

Bitcoin's role in the future

So what's next for Bitcoin? Will it replace traditional money? Will it become the global standard for storing wealth? Nobody knows for sure, but what's undeniable is that Bitcoin has already changed the conversation around money, technology, and freedom.

Some people see Bitcoin as a hedge against inflation, a way to protect their savings when traditional currencies lose value. Others view it as a tool for financial inclusion, giving people in underserved regions access to a global financial system. And many simply believe Bitcoin represents the future of money—decentralized, secure, and owned by the people who use it.

Bitcoin is more than just an investment or a trendy asset. It's a movement, a technology, and a fundamentally new way of thinking about value and trust. Whether you're looking to buy your first Bitcoin or just curious about what all the buzz is about, understanding Bitcoin is the first step toward participating in this financial revolution.

Resources

If you're interested in diving deeper and expanding your knowledge of Bitcoin, here are some suggestions: