What Are Crypto Whales and How to Track Them?

Sometimes crypto prices crash for no clear reason, and that’s usually a whale at work. These massive holders can move markets with a single trade, and tracking their activity can give you an edge most investors never get.

Written by Kacper Tomasiak

Oct 20, 2025

Picture this: you're watching your favorite cryptocurrency, maybe Bitcoin or Ethereum, when suddenly the price drops 10% in minutes. No major news, no obvious reason – just a massive sell-off that catches everyone off guard. Chances are, you just witnessed a crypto whale in action.

Understanding who these mysterious market movers are and learning to track their movements can completely change how you approach cryptocurrency investing. Whether you're just getting started or you've been buying crypto on platforms like Swapped.com for a while, knowing about whales gives you valuable insight into market dynamics that most beginners never learn about.

Who Exactly Are Crypto Whales

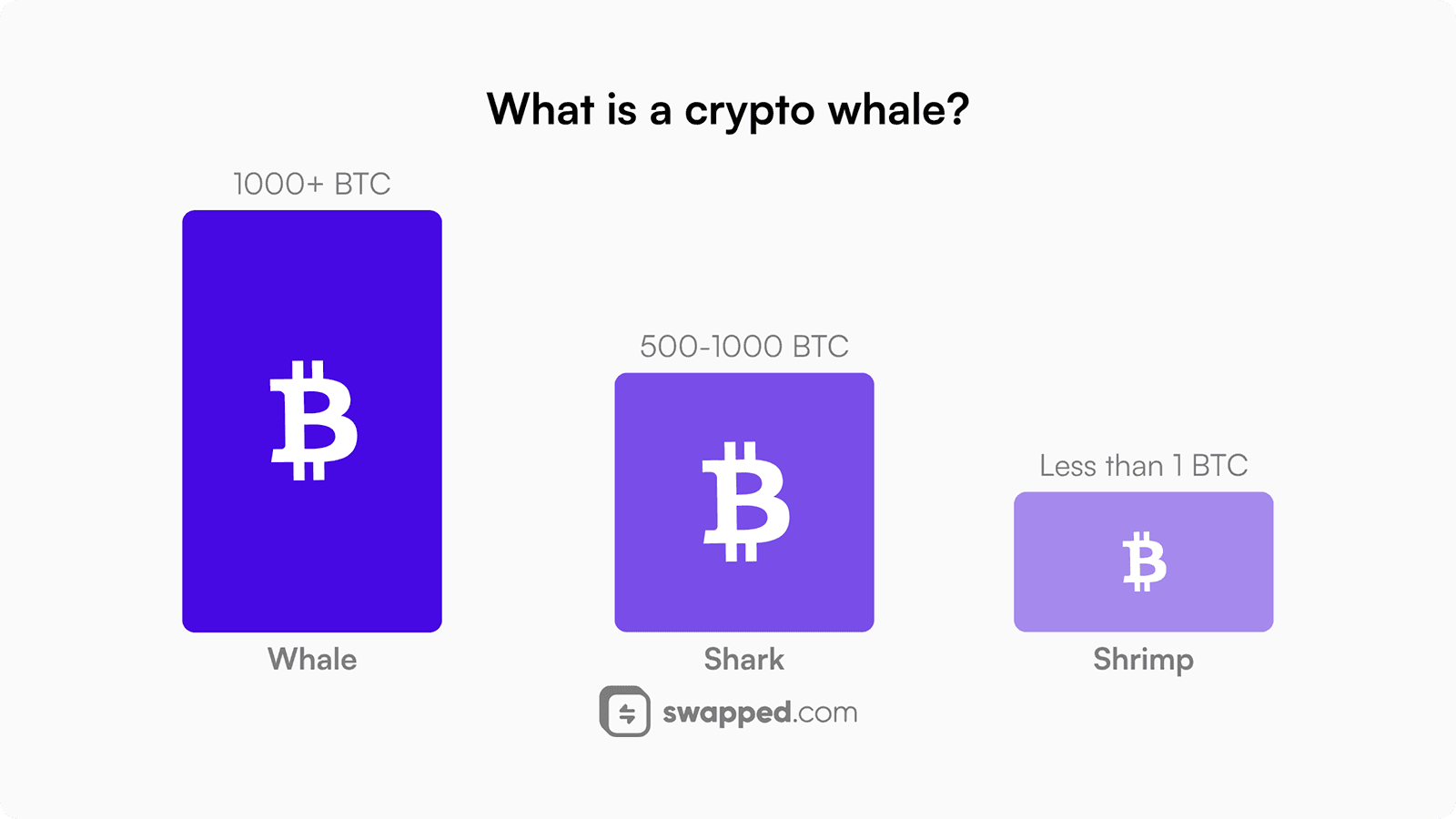

Crypto whales are individuals or organizations that hold massive amounts of cryptocurrency – we're talking millions or even billions of dollars worth. Just like how a whale is enormous compared to other sea creatures, these investors dwarf regular crypto holders with their massive holdings.

But here's what makes someone a whale: it's not just about having a lot of money. A crypto whale typically holds enough of a specific cryptocurrency to significantly impact its price when they buy or sell. For Bitcoin, this usually means holding at least 1,000 BTC (worth tens of millions of dollars). For smaller cryptocurrencies, you might become a whale with much less.

People who hold a lot of Bitcoin can move the price more than regular users.

The Different Types of Crypto Whales

Not all whales are created equal. Some are early Bitcoin adopters who bought thousands of coins when they cost less than a dollar. Others are institutional investors like hedge funds, corporations, or even governments that have recently entered the crypto space.

Then there are the exchanges themselves – platforms that hold massive amounts of crypto on behalf of their users. When you see a wallet moving 50,000 Bitcoin, it might not be one person making a trade, but rather an exchange rebalancing their cold storage wallets.

Why Crypto Whales Matter to Your Investment Strategy

Understanding whale behavior isn't just interesting trivia – it can actually help you make better investment decisions. When whales move large amounts of cryptocurrency, it often signals something important is about to happen.

Think about it this way: these investors didn't become whales by accident. They typically have access to better information, more sophisticated analysis tools, and deeper understanding of market trends. When they start accumulating a particular cryptocurrency, it might indicate they expect good news. When they start selling, they might see trouble ahead.

How Whale Movements Affect Crypto Prices

Large whale transactions can create immediate price impacts through simple supply and demand. When a whale sells 5,000 Bitcoin at once, it floods the market with supply, potentially driving the price down. The opposite happens when whales start accumulating – increased demand with limited supply pushes prices up.

But there's also a psychological effect. Other investors watch whale movements and often follow their lead. This creates a cascade effect where one whale's action triggers hundreds or thousands of smaller investors to do the same thing, amplifying the price movement far beyond what the original transaction would have caused.

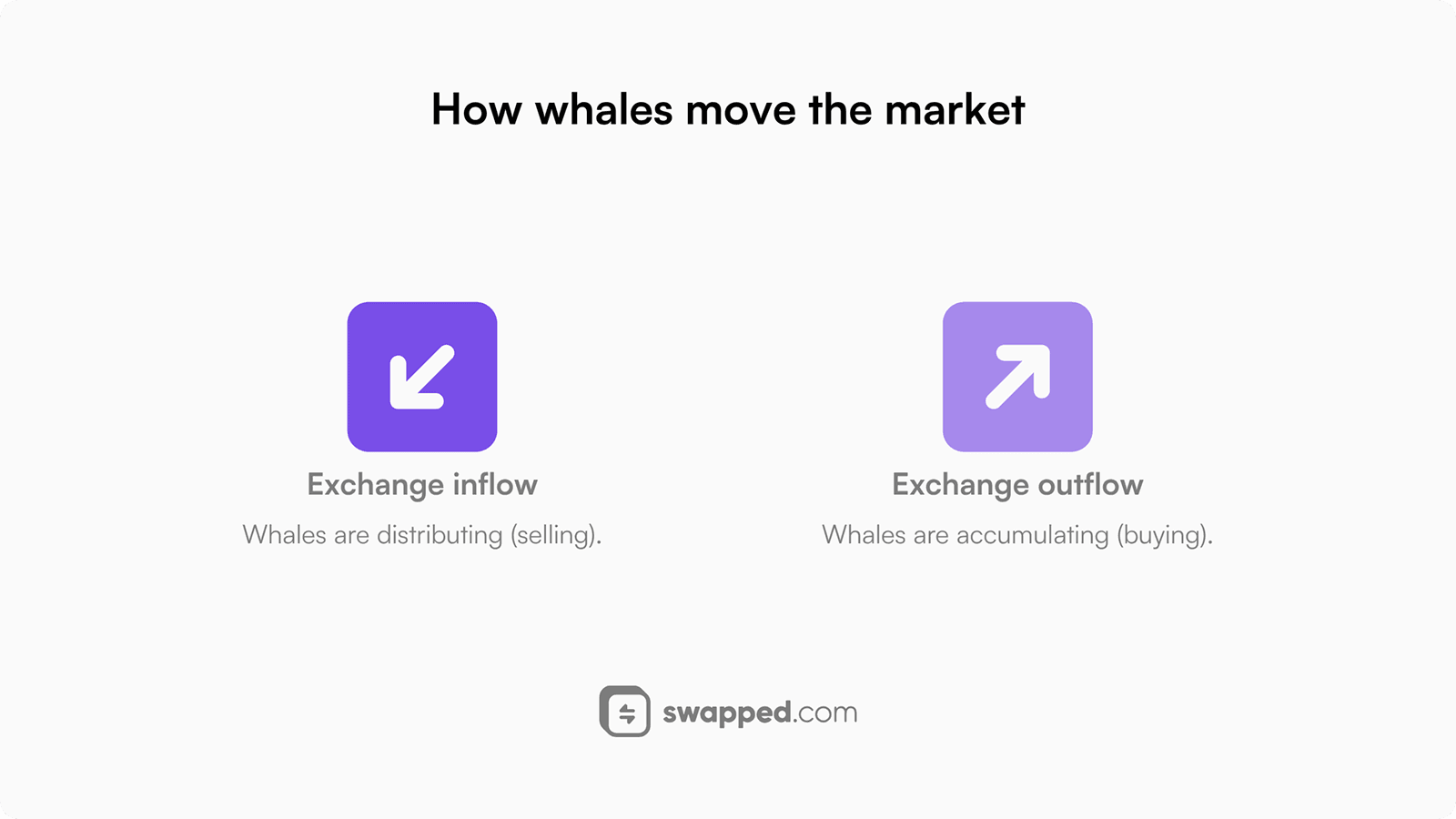

When big holders move coins to exchanges, they might sell. When they move coins away, they’re likely buying.

Essential Tools for Tracking Crypto Whales

Fortunately, cryptocurrency's transparent nature makes tracking whale movements possible for anyone. Unlike traditional financial markets where large transactions happen behind closed doors, blockchain technology records every transaction publicly.

The key is knowing where to look and what to look for. Most whale tracking happens through blockchain explorers and specialized analytics platforms that monitor large transactions in real-time.

Whale Alert and Real-Time Notifications

Whale Alert is probably the most popular tool for tracking large crypto transactions. This service monitors major blockchains and sends out alerts whenever someone moves significant amounts of cryptocurrency – typically $1 million or more.

You can follow Whale Alert on social media platforms like X, where they post real-time updates about major transactions. These alerts include details like the amount moved, which exchanges or wallets were involved, and sometimes even context about what the transaction might mean.

Blockchain Explorers for Deep Analysis

For more detailed investigation, blockchain explorers like Blockchain.info for Bitcoin or Etherscan for Ethereum let you dive deep into wallet addresses and transaction histories. These tools show you exactly how much crypto specific addresses hold and their complete transaction history.

The trick is learning to identify which addresses belong to whales versus exchanges or other entities. Whale wallets typically show patterns of large, infrequent transactions, while exchange wallets have constant smaller transactions from many users.

How to Interpret Whale Movements

Raw data about whale transactions is only useful if you know how to interpret it. Not every large transaction means something significant is about to happen, and some of the most important whale activity happens gradually over time.

Accumulation vs Distribution Patterns

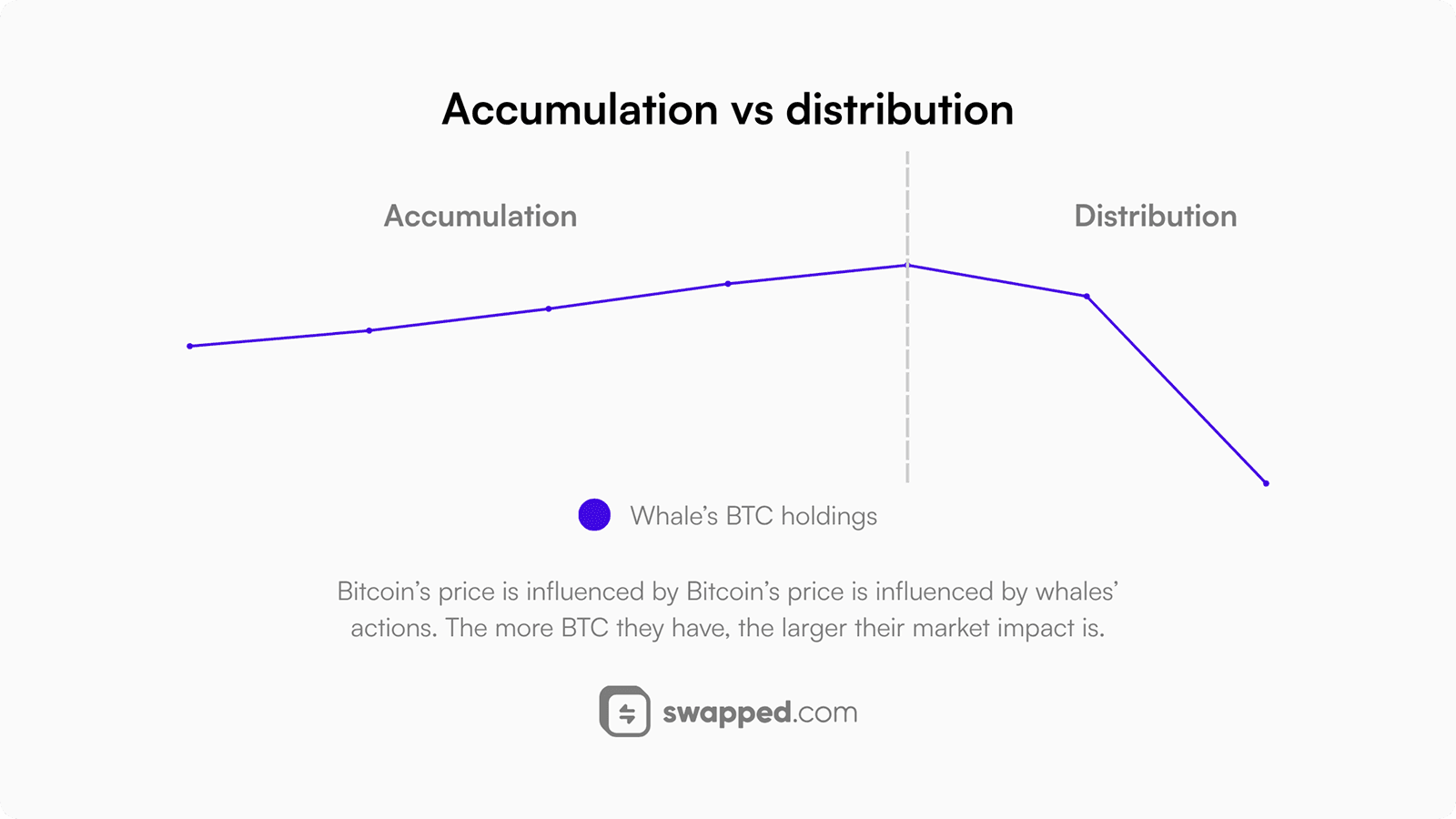

Smart whales rarely buy or sell all at once. Instead, they typically accumulate or distribute their holdings over weeks or months to avoid creating dramatic price movements that work against them.

Accumulation patterns show whales gradually increasing their holdings during price dips or sideways market movement. This often indicates confidence in the cryptocurrency's future prospects. Distribution patterns show the opposite – whales slowly reducing their positions, possibly in preparation for a price decline.

Whales slowly buy when they expect prices to rise and start selling when they think it’s time to take profit.

Exchange Inflows and Outflows

Pay special attention to large transfers between whale wallets and cryptocurrency exchanges. When whales move crypto to exchanges, it often means they're preparing to sell, which can create downward price pressure. When they withdraw large amounts from exchanges to private wallets, it suggests they're planning to hold long-term.

This is particularly important to understand when you're planning your next crypto transactions on platforms like Swapped.com. Seeing major whale outflows from exchanges might indicate a good time to buy, while large inflows could suggest waiting for lower prices.

Advanced Whale Tracking Strategies

Once you're comfortable with basic whale monitoring, there are more sophisticated approaches that can provide even deeper insights into market dynamics.

On-Chain Analysis Platforms

Professional traders use platforms like Glassnode, CryptoQuant, or Santiment to analyze whale behavior through advanced metrics. These services track things like whale transaction volumes, the number of active whale addresses, and even sentiment analysis based on social media activity from known whale accounts.

While these platforms often require paid subscriptions for full access, they provide much more context than simple transaction alerts. They can show you whether current whale activity is unusual compared to historical patterns and help you understand the bigger picture.

Correlation with Price Movements

Start keeping track of significant whale movements and how prices react over the following days and weeks. Over time, you'll begin to notice patterns that can help you anticipate market movements.

For example, you might notice that when a particular whale wallet starts accumulating, prices tend to rise within two weeks. Or you might find that whale selling during certain market conditions creates better buying opportunities than others.

What Beginners Should Watch Out For

While whale tracking can provide valuable insights, there are several common mistakes that new crypto investors make when trying to follow the big players.

Don't Chase Every Whale Movement

Not every large transaction deserves your attention or should influence your investment decisions. Sometimes whales are simply rebalancing their portfolios, moving funds between different storage solutions, or responding to personal financial needs that have nothing to do with market outlook.

Focus on patterns and trends rather than reacting to individual transactions. A single whale selling doesn't necessarily mean you should panic and sell too, especially if other indicators suggest the overall trend remains positive.

Consider the Timing and Context

Whale movements mean different things in different market conditions. A whale buying during a market crash might indicate they see a great opportunity, while the same whale buying at all-time highs might be driven by FOMO rather than careful analysis.

Always consider what's happening in the broader cryptocurrency market, regulatory environment, and general economic conditions when interpreting whale activity. The same transaction can have completely different implications depending on the context.

Making Whale Tracking Work for Your Investment Strategy

The goal isn't to blindly copy what whales do, but rather to use their activity as one piece of information in your overall investment approach. Think of whale tracking as market intelligence that can help inform your decisions, not replace your own research and judgment.

When you're ready to act on your analysis, having a reliable platform becomes crucial. Whether whale activity suggests it's time to buy the dip or take some profits, you want to be able to execute your trades quickly and cost-effectively. That's where Swapped.com excels – our low-fee, non-custodial platform lets you buy or sell crypto instantly when market opportunities arise.

Building Your Whale Watching Routine

Start simple by following different accounts on social media and checking major blockchain explorers a few times per week. As you become more comfortable with the data, you can expand to using more sophisticated analysis tools and developing your own tracking systems.

Remember that whale tracking is most valuable when combined with other forms of analysis like technical indicators, fundamental research, and market sentiment. The whales themselves use multiple information sources to make their decisions, and you should too.

The cryptocurrency market will always have its big players who can move prices with their actions. By understanding who they are, how to track them, and what their movements might mean, you gain a significant advantage in navigating this exciting but volatile market. Start with the basic tools and techniques covered here, and gradually build your whale watching skills as you gain more experience in the crypto world.

Resources

If you're interested in diving deeper and expanding your knowledge of tracking crypto whales, here are some suggestions: